Plastics Shortage Hits Plastic Parts Supply Chain

Raw Material Shortages Plus High Demand Disrupts Production

Manufacturers using prime and engineering grade plastics face ongoing shortages, price increases and delivery delays

Shortages and long lead times are affecting plastics goods productionSince March 2020, a perfect storm of events has been putting severe strains on supplies of plastic raw materials, base plastics and compounded plastics. This shortage has hit plastic product manufacturers very hard.

Plastics supplies were tight even before Winter Storm Uri's disastrous effects on US production. It is essential to keep in mind that the trend towards tight plastics supplies had been building before the fourth quarter of 2020.

The effects of these material shortages are very tight supplies, historically high prices and delivery delays. And these effects extend to components, especially parts made with prime grade and engineering grade plastics.

Why the current state of the resin market?The market is unable to supply the current US demand for plastics. Worldwide markets for plastics are also experiencing significant disruptions. The ongoing interaction of four primary factors have created the current situation:

- Labor

- Inflationary pressure

- Supply and demand disruption

- Logistics (transportation and supply chain management)

Key events and causes of the current plastic raw materials supply problemsWhen COVID first hit the US in March 2020, plastics suppliers reduced stocks based on uncertainties about COVID's effects on the market. But, changes in the plastics market did not go as expected.

As the social effects of COVID settled in, there was a surge in demand for plastic products. This surge primarily came from changes in consumer buying behavior.

In 2020, the worst hurricane season in years negatively affected hydrocarbon extraction and processing in the Gulf of Mexico and the American Gulf Coast. It included two back-to-back hurricanes hitting Louisiana within two weeks.

The logistics industry became overwhelmed by shipping volumes both domestically and internationally. Early Asian COVID recovery and mushrooming demand in all markets caused this increase in international trade volume.

- Port bottlenecks

- Over the road truck capacity shortages

- Container shortages for Asian exports leading to a worldwide container shortage

The demand for plastics continues to surge, especially for

- Food packaging

- Automobile components

- PPE (personal protective equipment)

Winter storm Uri hit Texas and Louisiana chemical processing and plastics manufacturing hard and almost caused the Texas energy infrastructure to almost completely collapse. This crippled refinery and chemical operations.

- Lost oil and natural gas flow for plastic raw material processing

- Loss of natural gas and electrical supply to keep plants running intensified freeze damage

- Significant mechanical damage from extended periods of unusually low freezing temperatures

Typical plastic injection molding machine

More about plastics supply and demand disruptionsThe three largest plastics markets are the US, Europe and Asia. 2020 third-quarter demand for plastics was strong in all three markets. Demand remains strong in the first quarter of 2021 and continues to increase.

Strong worldwide demand for plastics and logistics problems prevents or significantly increases the costs of reallocating plastic feedstock chemicals and plastics between markets.

Labor issues and plastics production

COVID had impacts on labor and staffing that hurt plastics production

COVID reduced chemical and plastic plant productivity because of its effects on staffing. Production schedules have had to compensate for the sudden unavailability of symptomatic employees and employees going into quarantine.

Oil and gas chemical processing and plastic manufacturing plants generally are extensive, open-air facilities. These plant layouts have made it relatively easy to provide safe employee distancing, but only when everything is working correctly.

The situation is much different when there are problems and repairs are needed. COVID safety measures significantly extend the length of time before a plant or unit is back up and running at full production.

COVID, labor and plant turnarounds

A significant COVID effect on labor is what it does to plant preventative maintenance turnaround or shutdown cycles. Polymer (plastics) manufacturing plants must go through these regular, major maintenance shutdowns every three to five years.

Many polymer plants delayed their 2020 maintenance shutdowns, hoping for relief from the need for COVID safety measures. With no change at hand, 2020 scheduled shutdowns can no longer be delayed. Plastics plants in the Gulf States and Asia made the same decision, pausing their scheduled 2020 maintenance shutdowns.

Every market must now cope with delayed 2020 plastic production plant turnarounds that must happen in 2021. These turnarounds are in addition to the 2021 maintenance shutdowns already scheduled.

COVID safety measures also increase the amount of time needed for a chemical or plastics plant turnaround. Standard plastics manufacturing plant turnarounds are 30 days. Turnarounds are currently running at 60 days.

More detail about the effects of COVID on the increase in demand for plasticsInitial planning for COVID effects on the plastics market was wrong. Demand either went up instead of going down as expected or else dipped sharply and recovered even more sharply. Historical projections for plastics demand were also off because of COVID-related changes in consumer buying behavior.

COVID has changed the marketplace demand for plastics

- Remote working and schooling created an increased demand for electronics

- Higher and growing demand for both the food packaging and healthcare markets

- Automotive production rebounded and surged beginning in the third quarter of 2020

Summer 2020 consumer spending significantly increased the demand for

- Do-it-yourself*

- Building and construction

- Appliances or "white goods"

- Televisions and electronics

Pandemic-induced 'nesting' fuels Home Depot and Lowe's sales—Why it's likely to continue >>

*Home Depot sales are the best example, and this report from CNBC describes what has been happening.

Unexpected repairs and plant shutdowns hit all plastics markets

Unscheduled chemical processing and plastics manufacturing plant shutdowns

Mechanical issues caused unexpected oil and gas refining plant shutdowns. These shutdowns happened off and on throughout 2020 and in all markets. The result was reduced supplies of plastic chemical components (feedstock), which lowered plastics production.

Global Crude Oil Refinery Maintenance Review 2020-2021 (Cision PR Newswire) >>

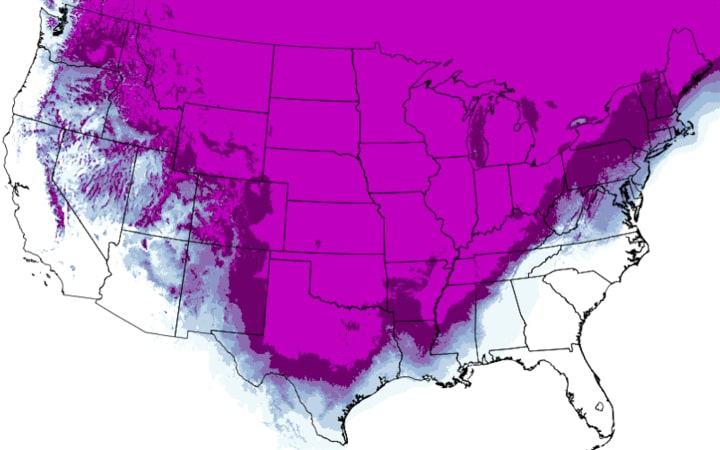

Winter Storm Uri decimated plastics production in Texas and LouisianaWinter Storm Uri disrupted the entire Texas and Louisiana oil and natural gas supply chain. Uri also caused extensive damage to plastics component chemical processing and plastics manufacturing plants.

NOAA map showing hours below freezing February 12th through 19th, 2021

Logistics problems have made transportation a big problem for plasticsInternational shipping is currently unable to reallocate significant volumes of plastics and plastic raw materials.

The cascading effect of logistics problems limits the movement of plastics between markets. Even if adequate shipping capacity was available, all markets are experiencing tight supplies of plastics.

Global supply chains choke under tsunami of freight (American Shipper) >>

Some other related logistics issuesCongestion at seaports is a critical logistics disruptor, and this congestion has several facets. The main reason behind these ripple effects is COVID safety measures and the resulting terminal restrictions.

- Driver shortages

- Reduced trucking capacity

- Reduced availability of port labor (longshoremen)

The volume of trade coming from Asia is up significantly. Container carriers are prioritizing getting empty containers back to China. This loss of empty containers means the US domestic container supply is inadequate to meet demand.

Container availability remains tight worldwide

- Shortage of containers worldwide

- Increased trade volume from Asia, primarily China

Dramatically reduced air service has limited the availability of air freight capacity in passenger planes. Dedicated air freight carriers have been unable to compensate for this loss of air cargo capacity.

Air cargo 2021: The good, the bad and the ugly (American Shipper) >>

Plastics industry supply problems are record-breakingOn top of all the other problems affecting the plastics industry, Winter Storm Uri's effects are unprecedented. The current situation is simply beyond the experience of all professionals in the chemical and plastics processing industry.

The disruption of US domestic plastics production created severe problems for US plastics converters or plastics products manufacturers.

The current situation is simply a crazy time, and you should expect ongoing:

- Price inflation

- Delays in lead times

Into the summer and probably throughout the remainder of the year, plastics raw materials will deliver late to plastic product molders. This plastic will also come with an increasing price tag.

Plastics for plastic products manufacturing will arrive later and in significantly smaller volumes than initially contracted.

What needs to happen to restore US plastics productionFor US plastics production to recover, a complete interconnecting chain of plant repairs and re-starts needs to occur in Texas and Louisiana.

There is a sequence to this chain of startups also. It needs to begin with restoring crude oil and natural gas extraction and distribution flows.

These steps need to happen for plastics production recovery, and roughly in this order:

- Repair oil and natural gas extraction and transportation infrastructure

- Repair oil and gas refining and processing plants

- Return to normal volumes of chemical feedstock production for plastics production

- Repair plastics manufacturing plants

- Return to normal volumes of plastics production

- Repair plastics compounding and extruding machinery locked up by hardened plastic frozen in place

AMCO Polymers Petrochemical Feedstock Flow Chart (PDF download) >>

Some good news about Texas plastics plantsPolymer plants have been re-starting to test that everything is in good working order, but this does not mean a return to full production. Full production requires plastics plants to begin receiving adequate supplies of all the necessary chemical raw materials (plastics feedstock).

How can ISM help you cope with the effects of the current plastics shortage?

ISM will continue to rely on our customer service best practices. These include good communication providing timely and relevant updates and notices regarding your orders.

We have always placed a premium on personalized communication. There will continue to be live representatives available by phone during regular business hours. You can also count on quick responses to your digital requests for information or help.

Contact ISM and get answers to your questions about our products and services >>

What ISM is known for and what you can continue to expect:

- Clear, timely and direct communication

- Careful management of your orders and manufacturer delivery schedules

- Hands-on, personalized customer service with easy telephone access to a live person

- ISM leveraging our strong working relationships with partner suppliers to help solve your delivery problems

Remember, plastics supply chain disruptions will continue into the summer and may not let up until late this year or early next year.

Resin supply expected to take months to recover (PMM, Plastics Machinery and Manufacturing) >>

List of Primary References

- Air cargo 2021: The good, the bad and the ugly (American Shipper) >>

- AMCO Polymers Petrochemical Feedstock Flow Chart >>

- Contract Implications Amid COVID-19 Concerns: Force Majeure, Impossibility, and Frustration of Purpose >>

- Global Crude Oil Refinery Maintenance Review 2020-2021 (Cision PR Newswire) >>

- Global Supply Chains Choke Under Tsunami of Freight (American Shipper) >>

- The Resin Crisis: Information Every Plastics Processing Executive Must Know (AMCO Polymers and MAPP, Manufacturers' Association for Plastics Processors) >>

- Resin Plastic Production Process: From Pellet to Powder (RSP Inc.) >>

- Resin supply expected to take months to recover (PMM, Plastics Machinery and Manufacturing) >>

« Go back to the blog homepage